Fintech start-up Revolut has secured a European banking licence as it steps up preparations for a hard Brexit.

The company, which launched three years ago allowing customers to transfer money abroad with the real exchange rate, sought the licence partly to “hedge against any issues regarding Brexit”, according a source.

The source added that Revolut intends to apply for a UK banking licence but has not yet officially done so, and will provide further information in the new year.

Revolut secured the licence from the Bank of Lithuania and it was approved by the European Central Bank.

Uncertainty surrounding the UK’s departure from the European Union at the end of March has been raised after Conservative MPs triggered a vote of no confidence in Prime Minister Theresa May.

After Brexit, financial services companies in the UK will lose passporting rights to trade with firms across European Union’s single market.

The company said it will take three to six months for Revolut to begin passporting its banking licence across Europe, focusing initially on the UK, France and Poland.

The European banking licence will allow Revolut’s customers to deposit their salaries, which will be protected up to 100,000 euros (£90,000) under the European Deposit Insurance Scheme.

Nik Storonsky, founder and chief executive, said: “With the banking licence now secured, commission-free stock trading progressing well and five new international markets at final stages of launch, we are living up to our reputation as the ‘Amazon of banking’.

“Our vision is simple: one app with tens of millions of users, where you can manage every aspect of your financial life with the best value and technology.”

Revolut has grown rapidly since it was founded in 2015 by former Credit Suisse and Deutsche Bank investment bankers Mr Storonsky and Vlad Yatsenko.

In April the firm reached unicorn status – a company worth more than a billion US dollars – after it raised 250 million dollars. To date the company has raised 340 million dollars from venture capitalists.

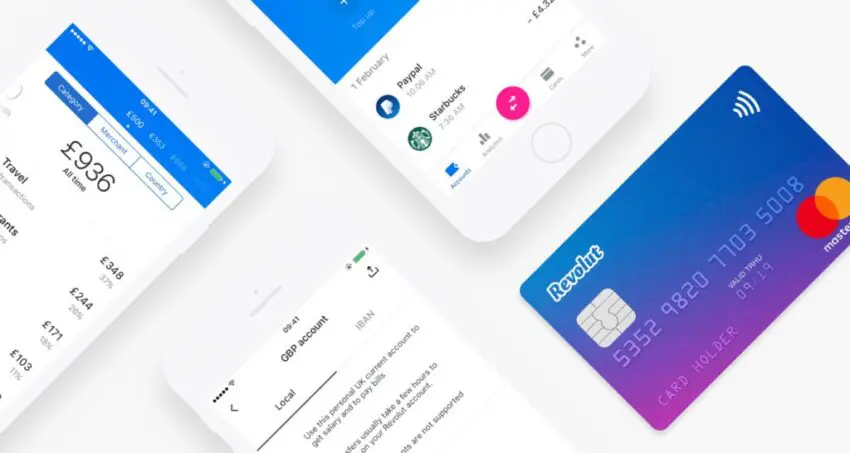

The company is moving into the banking space, challenging traditional high street lenders for a share of the market. Revolut said it will also offer overdrafts and personal and business loans to customers at competitive rates compared with high street banks.

Revolut opens between 8,000 and 10,000 current accounts a day and processes more than 4 billion dollars a month.

Mr Storonsky said: “Our vision is that retail and business customers will be able to apply for a loan in just two minutes from within the app, and then have the money in their account almost instantly.

“We’ll remove the bureaucratic process and come in cheaper than traditional lenders.”

The company is expected to launch in the US, Canada, Singapore, Japan, Australia and New Zealand early next year.