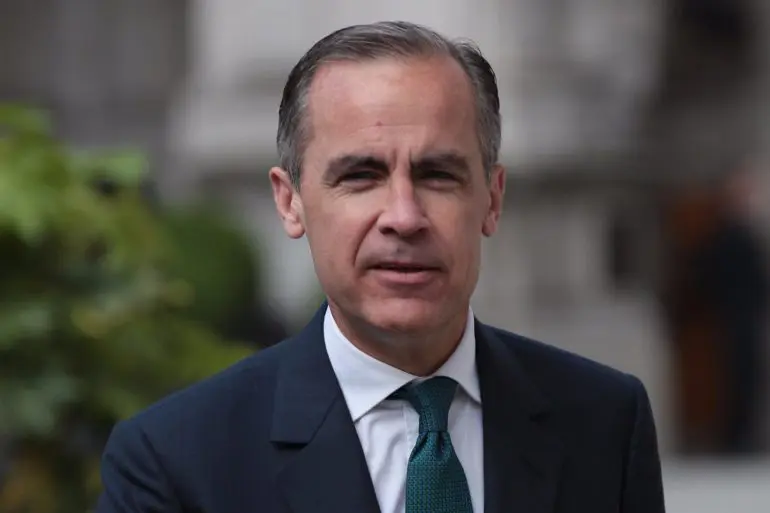

Former Bank of England governor Mark Carney has definitively ruled out any role in a future Labour government.

When asked about the possibility of an official position or whether he had received any offers, Mr Carney laughed and responded, “My time in UK officialdom is over.”

Mr Carney, who led the Bank of England from 2013 to 2020, has recently sparked speculation about a potential political career in the UK after formally endorsing shadow chancellor Rachel Reeves at the Labour Party conference last autumn. Additionally, he is advising her on the creation of a National Wealth Fund.

Despite these endorsements, Mr Carney, a Canadian financier, has steered clear of frontline politics. In his home country, he has been suggested as a potential successor to Justin Trudeau as leader of the Liberal Party. Instead, since leaving the Bank of England, Mr Carney has focused on coordinating global efforts to finance net zero initiatives.

At an event hosted by Deloitte at the London School of Economics, Mr Carney called for changes in government rules to make the Bank of England and the Financial Conduct Authority (FCA) play a more active role in achieving net zero. He stated, “The remit of financial authorities, including the Bank of England, the FCA, should be refreshed to ensure that they in a hierarchical way support the government’s net zero objective.”

These comments follow Chancellor Jeremy Hunt’s decision last year to downgrade the emphasis on climate change in the Bank of England’s objectives, a move that shadow chancellor Rachel Reeves has vowed to reverse.

Mr Carney had a notable focus on climate change and green finance during his tenure at the Bank of England. However, his predecessor, Mervyn King, has argued that this focus on net zero distracted the Bank from its primary objective of controlling inflation.

In his speech, Mr Carney highlighted that global shocks had left the UK economy 40% smaller than it would have been if it had continued to grow at the pre-financial crisis rate. He noted that the UK and other countries are facing the most significant regime change in geopolitics and economic policy since the fall of the Berlin Wall.

Given these pressures and sluggish growth, Mr Carney emphasized that private capital would need to lead the net zero transition. He cautioned the UK against trying to match the US’s Inflation Reduction Act, citing a lack of fiscal capacity. “Budget constraints require a targeted approach and striking the right balance. These are big judgments to be made about encouraging domestic activity and lower-cost solutions through imports,” he concluded.